GEMINI STRUCTURED CARBON LIMITED | Email: research@geminicarbon.com

Lance Coogan

Outperforming The Clean Dark Spread

1. INTRODUCTION – THE GEMINI GROUP (Lance Coogan

Gemini Structured Carbon Limited

and

Gemini Environmental Markets Limited

SOME SIGNIFICANT ACHIEVEMENTS:

- First Certified Emission Reduction (CER) Option deal

- OTC basis and was Guaranteed Delivery

- First brokered Investment Grade Guaranteed Delivery CER Forward deal.

- Structured one of the largest VER deals in 2007

- Designed and developed Carbon Spread options.

- First listed CER Option deal. This was traded on Nymex.

- Structured the largest single Nordpool Carbon deal.

- Structured 50% of CER Options on the ECX for 2008

- Structured 67% of CER Options on Nymex for 2008.

- Largest single option deal on ECX in 2008.

- As of today’s date responsible for the largest one day turnover in options of 20m tonnes.

- As of today’s date responsible for the 7 largest option transactions on the ECX.

- 16m tonnes, 2 x 12m tonnes, 2 x 8m tonnes and 2 x 6m tonnes (not including delta hedges)

- Concluded the first ERU option deal.

- Concluded the first call option on a ERU/CER swap.

- Concluded the first CER/ERU Swaption.

- Currently developing pricing models for Forestry Derivatives.

- CDM project lead Carbon Advisor for:

- The development of the Scaw Metals for AngloAmerican PLC in SA.

- The development of the New Denmark Mine for AngloAmerican PLC in SA.

- NT Energy Coal Bed Methane Project in a JV with the SA Government.

- Equity holder in AfricaGeotherm Ltd and Namib Geopower, advancing opportunities in Solar and Geothermal power in SA and Namibia.

- Presently concluding significant Solar Power deal in France.

- Consultant to the World Bank on use of Carbon Derivatives

- Consultant to the State of Victoria in Australia on decarbonising coal.

- Consultant to the Government of the Netherlands on reducing price exposure on the carbon credits

The Gemini Group is also focusing on many renewable energy opportunities, including actively pursuing solar opportunities in Namibia, South Africa, Australia, and in California in the US.

SPREAD DEFINITIONS:

Heat Rate:

Measure of a power plant’s thermal efficiency, by indicating how much heat is needed to produce electricity expressed in terms of Btu per k/Wh.

Computed by dividing the total Btu content of the fuel burned by the resulting net kWh generated.

Dark Spread:

Financial indicator showing the theoretical gross income of a coal-fired power plant.

Obtained by selling the electricity after having purchased the fuel necessary to generate it.

Dark Spread = Price of Electricity – [(Cost of Coal) * (Heat Rate)]

(assuming all prices expressed in the same units)

Clean Dark Spread:

Financial indicator showing the theoretical gross income of a carbon-compliant coal-fired power plant,

Obtained by selling the electricity after having purchased the fuel and the necessary carbon allowances.

Clean Dark Spread = Dark Spread – [(Cost of Carbon) * (Fuel Emission Intensity)]

(assuming all prices expressed in the same units)

Factors:

Power: driven mainly by fuel prices and carbon prices on a long-term basis

and by load factors on a short-term basis.

The initial investment outlay for plants, relative to their lifetime, also defines the fixed costs that power producers incur for each plant.

Fuel: Coal prices are driven by availability and demand for coal and reserve levels

possible additional shipping costs and oil prices

Electricity prices are positively correlated to coal prices, meaning each move in coal prices will bring a lesser move in electricity prices.

A decrease in correlation will therefore increase the likelihood of moves in the dark spread, as prices will tend to abandon parallel shifts.

Carbon: driven by supply (through allowance levels and supply of credits by from projects) and demand (both legislated and caused by emission-intensive productions), and market factors in the short term.

Electricity prices are positively correlated to carbon prices, meaning each move in carbon prices will bring a lesser move in electricity prices.

A decrease in correlation will therefore increase the likelihood of moves in the clean dark spread, as prices will tend to abandon parallel shifts.

MARKET ASSUMPTIONS

OTC Settlement Price for UK Season Baseload Futures at the close on 04/10/2009 The power company generates power, and therefore has an inherently long power position.

The power company generates power, and therefore has an inherently long power position.

OTC Settlement Price for CIF ARA Index-based Futures at the close on 04/10/2009

To produce power, the company buys coal and therefore has an inherently short coal position.

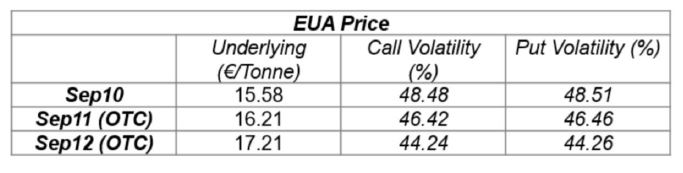

ICE ECX and OTC Settlement Prices for EUA Futures at the close on 04/10/2009

For compliance the company buys EUAs and therefore has an inherently short EUA position.

Forward London Exchange Rates on the 04/10/2009

USD/GBP – September 2010: 1.6386

EUR/GBP – September 2010: 1.1462

Fuel Efficiency

Based on Drax’s publicly disclosed figures, it is conservatively estimated at 38% for year 2010, and is set at 40% for years 2011 and 2012, after the planned turbine modernisation is complete.

The fuel used for our calculations is black steam coal similar to the one used by Drax (6000kCal/kgCE, or 23,794Btu/kgCE), with a shipping cost for the UK estimated to be close to the ARA shipping cost.

Emissions intensity

For year 2010 it is set at the market value of 0.969tCO2e/1MWh.

However, taking into account the above-mentioned gain in efficiency and Drax’s plans to increase its use of biofuel it is set at 0.847 tCO2e/1MWh for years 2011 and 2012.

1 – REDUCING COSTS

SUGGESTED STRATEGY:

Buy Winter 09/10 £37.95 Strike ATM UK Baseload Puts for -£2.96 for 5,000 MWh

Buy Summer 10 £37.45 Strike ATM UK Baseload Puts for -£3.31 for 5,000 MWh

Total ATM premium paid: -£31,350

Sell Year 2010 $77.29 Strike ATM CIF ARA Puts for $7.83 (£4.78) for 3,780 tons

Total ATM premium received: $29,597 (£18,068)

Sell Sep 10 €15.58 Strike ATM EUA Puts for €2.86 (£2.49) for 9,690 tons

Total ATM premium received: €27,713 (£24,128)

Complete ATM initial cash flow: £10,846 equivalent (per 10,000MWh yearly tranche)

EXECUTIVE SUMMARY:

This strategy locks in a floor price for a long UK power position whilst still allowing significant participation in upside UK power price movements.

Cash buffers are generated for coal and EUA purchases at £4.78 and £2.49 per tonne respectively.

Should the coal and EUA prices move up on expiry, these cash buffers represent:

Coal purchases at a 10.1% discount to ATM level

EUA purchases at an 18.3% discount to ATM level

Should the coal and EUA prices move down on expiry:

Coal purchases at a 19.9% discount to ATM level

EUA purchases at an 11.7% discount to ATM level

Coal Position:

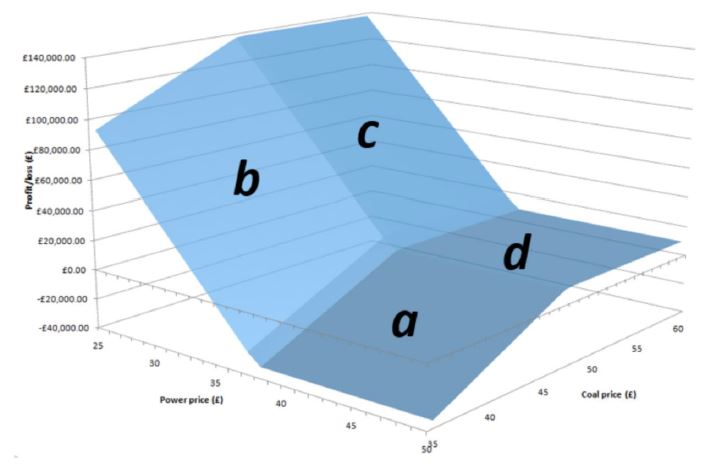

Surfaces ‘a’ and ‘b’ represent the P&L of the strategy relative to the spot price, with guaranteed purchase of Coal delivered through exercise of Coal Put option.

Surfaces ‘c’ and ‘d’ represent the P&L of the strategy relative to the spot price, with cash buffer available to purchase Coal in the market.

UK Power Position:

Surfaces ‘a’ and ‘d’ demonstrate how the strategy facilitates participation in upside price movements by enabling sale of power in the market should the spot price move higher.

Surfaces ‘b’ and ‘c’ demonstrates how the strategy locks in a floor price for the sale of UK power above the current spot price should the market move down.

OPTION PROFILES OF INDIVIDUAL ASSETS

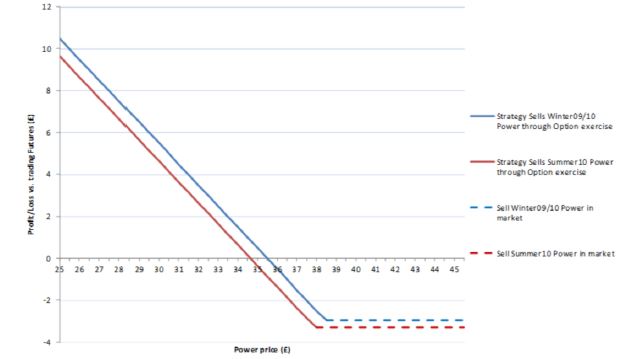

Fig 2 illustrates how going long UK power puts locks in a floor price (solid lines) if market price moves down.

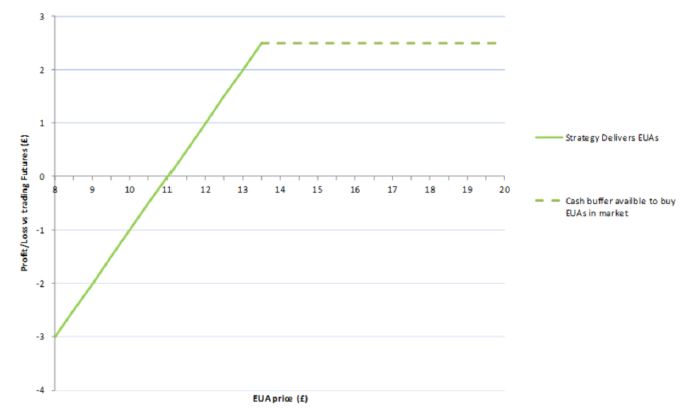

If the UK power price moves up the puts are not exercised and upside price participation is achieved by selling power in the market (dotted lines).

Fig 3 and 4 show how writing puts on Coal and EUAs outperforms buying futures ATM by an amount equal to the premium received. Delivery of these assets is guaranteed if the market on expiry is lower than the strike price (solid line).

Furthermore if the market price is higher than the spot price on expiry the premium acts as a cash buffer to subsidies purchases made in the market (dotted line).

…

*** PLEASE NOTE THAT ONLY SUBSCRIBERS TO THE DIGITAL PACKAGES WILL HAVE FULL ACCESS TO THIS ARTICLE ***

If you would like to get access to a piece of content, or purchase a full article, please contact our customer services team at research@geminicarbon.com